how to get amazon flex tax form

Attach Form 4852 to the return estimating income and withholding taxes as accurately as possible. There may be a delay in any refund due while the information is verified.

Where Amazon Flex Drivers And Instacart Shoppers Find 2018 1099 Tax Forms Rideshare Dashboard

Driving for Amazon flex can be a good way to earn supplemental income.

. To save the form to your computer while it is open in Adobe Reader click File then Save As and then PDF. Payee and earn income reportable on Form 1099-MISC eg. Amazon Payments will mail a copy of your form to the address which you provided when you gave us your Tax ID Number EIN or Social Security Number.

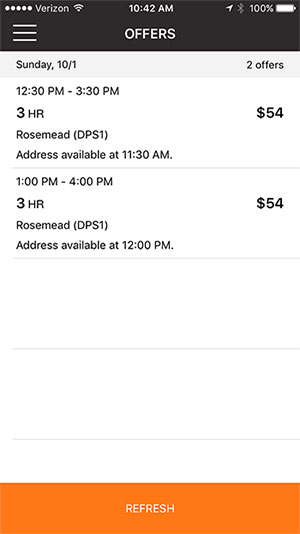

You can plan your week by reserving blocks in advance or picking them each day based on your availability. Choose the blocks that fit your schedule then get back to living your life. Taxes for Uber Lyft Postmates Instacart Doordash and Amazon Flex drivers are handled differently than what most full time workers are used to.

In your example you made 10000 on your 1099 and drove 10000 miles. Once you have completed the form and signed with blue or black pen please mail to Amazon at. Under My Account click Tax Information.

Tax Returns for Amazon Flex. With Amazon Flex you work only when you want to. Royalty or rent income by participating in one or more Amazon programs you may be eligible to receive a 1099-MISC if you meet the reporting threshold 10 for royalties and 600 for all other payments.

The FTC brought a. 2 Go to the Reports Section. Get it as soon as Tomorrow Feb 16.

This video shares information on where to find your 1099 expenses you should take into account to reduce your taxable i. Since my account is now only used for Flex they. Select a location on your computer and click Save.

Blue Summit Supplies 1099 NEC Tax Forms 2021 with 25 Self Seal Envelopes 25 4 Part Tax Forms Kit Compatible with QuickBooks and Accounting Software. 46 out of 5 stars. Supplier number vendor code publisher code etc.

Click the Download PDF link. Im trying to access my tax forms for last year. From the Reports section in your seller account select Tax Document Library then the appropriate year and then Form 1099-K.

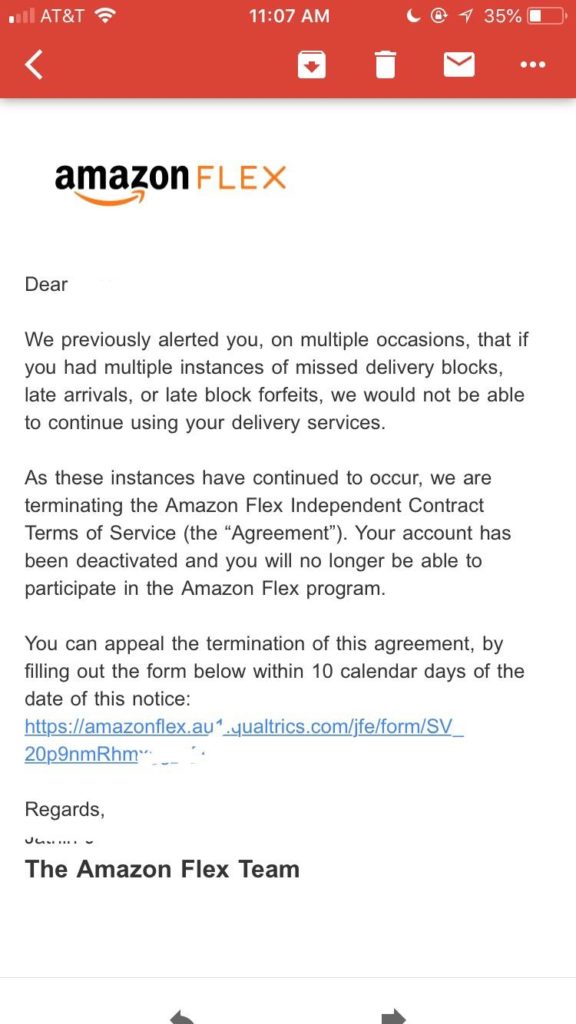

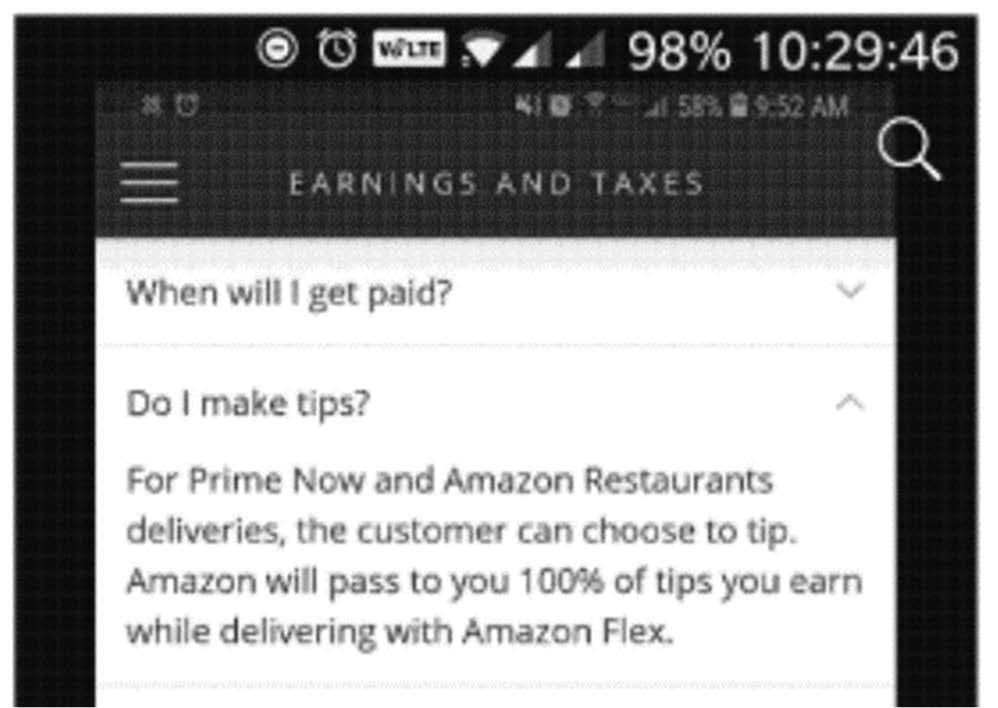

This form will have you adjust your 1099 income for the number of miles driven. This is your business income on which you owe taxes. Amazon Flex drivers deliver goods and groceries ordered through programs like Prime Now and AmazonFresh which allow customers to leave tips for their drivers.

We are actively recruiting in. Beyond just mileage or car expenses getting a 1099 from Amazon means that you can claim a lot of other expenses as tax write offs -- the phone. Gig Economy Masters Course.

Box 80683 Seattle WA 98108-0683 USA. 1 Login to Seller Central. Generally payments to a corporation including a limited liability company LLC that is treated as a C- or S-Corporation do not receive.

Knowing your tax write offs can be a good way to keep that income in your pocket. Tax deductions that Amazon Flex drivers can claim include. Austin TX Binghamton NY Milwaukee WI.

I dont have that phone number anymore. Youll need to submit a tax return online declaring your income and expenses once a year by 31 January as well as paying tax twice a year by 31 January and 31 July. 46 out of 5 stars.

Scroll down to the Year-End Tax Forms section. The FTC is sending payments totaling nearly 60 million to more than 140000 Amazon Flex drivers who had their tips withheld from them by Amazon between 2016 and 2019. I contact Amazon account recovery and they go through some recovery questions.

Its almost time to file your taxes. You can deduct the mileage you incur from driving for Amazon Flex. 1099 MISC Forms 2021 4 Part Tax Forms Kit 25 Vendor Kit of Laser Forms Designed for QuickBooks and Accounting Software 25 Self Seal Envelopes Included.

Mail a 4506-T Request for Transcript of Tax Return form which can be found on the Printable Forms section of our webpage wwwhostoscunyeduofa. Like every year I go to the website taxcentralamazon but this time it is asking for authentification from an old phone number. Amazon business for which you are supplying information.

If you think you should have received a form 1099-K but didnt you can check on it in your Seller Central Account. We will issue a 1099 form by January 29 to any Amazon Associate who received payments of 600 or more or received payments where taxes were withheld in the previous calendar year unless you are an exempt entity. Follow the instructions for two-step verification.

Youll need to declare your amazon flex taxes under the rules of HMRC self-assessment. Use your KDP account sign-in and password. Increase Your Earnings.

Will I also get a 1099-MISC form. Amazon will either mail or email you your form 1099-K depending on whether or not you consented to having tax forms sent to you electronically. Please include the following information on your form so that we can locate your account.

Get it as soon as Wed Feb 23. Click the Find Forms button. 12 tax write offs for Amazon Flex drivers.

Click ViewProvide Tax Information. If you are a US. Understand that this has nothing to do with whether you take the standard deduction.

Use the standard mileage rate or the actual expense method that factors in the real cost of vehicle expenses such as gasoline and repairs. Since we are now considered self employed contractors we are now responsible for own taxes including payroll deductions for Social Security and Medicare. If you have not received your Form W-2 by the due date and have completed steps 1 and 2 you may use Form 4852 Substitute for Form W-2 Wage and Tax Statement.

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

![]()

How To Get More Amazon Flex Delivery Blocks Assigned Money Pixels

Can You Deliver For Amazon Flex Driver Requirements Job Overview Ridesharing Driver

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

Everything You Need To Know About Amazon Flex Gridwise

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

Amazon Enters Gig Economy With Uber For Packages Service Amazon The Guardian

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

Amazon Flex Tax Forms Info On Income Tax For Amazon Flex Drivers

How To File Amazon Flex 1099 Taxes The Easy Way

Everything You Need To Know About Amazon Flex Gridwise

Can You Deliver For Amazon Flex Driver Requirements Job Overview Ridesharing Driver

Can You Deliver For Amazon Flex Driver Requirements Job Overview Ridesharing Driver

Amazon Pagara 61 7 Millones De Dolares Para Resolver Los Cargos De La Ftc Que Indican Que Retuvo Una Parte De Las Propinas Ofrecidas Por Los Clientes De Amazon Flex A Los Conductores

Where Amazon Flex Drivers And Instacart Shoppers Find 2018 1099 Tax Forms Rideshare Dashboard

Amazon Flex Tax Forms Info On Income Tax For Amazon Flex Drivers